There are some things you just don’t skimp on, but other entities just aren’t worth the price tag. Saving money on a single purchase is good, but the real savings come when you’re able to slash monthly payments. We usually end up paying more because of time constraints or not realizing that saving is even an option. So here are 14 ways you can easily cut costs.

1. Medication

Instead of buying branded medicines, go for generic drugs as they cost a lot less.

Generic drugs can cost you up to 40% less. Instead of wasting money on fancy packaging and a recognizable name, you should always go for a generic brand. The prices vary widely from pharmacy to pharmacy, so it pays to shop around before you buy your lot. Next time you visit your doctor, ask him if a brand-name medication is available as a generic one as well.

2. Haircuts

People are usually very sensitive about their hair and so they a pay a little extra to make sure they are in good hands. But there are always some means to cut back on the haircuts without sacrificing on the quality. If you visit the saloon twice a month to keep your hair in shape, then you should make it to once a month. This will double your savings right away.

3. Bank Fees

Maintain the minimum balance amount in your bank account to avoid getting charged by the bank.

Have you ever wondered how the bank makes profit? Other than the interest it charges on loans, there is a maintenance fee that the bank automatically deducts from your account. You can cut back on these maintenance charges by maintaining a minimum balance in your account or having a certain number of bills paid automatically from the account.

4. Gift Cards

Buy gift cards online instead of buying them directly from the store.

The stores charge way more for a gift card than what it’s actually worth. So a better option is to look for a card online, where gift cards can be purchased for less than the face value. Even brands like iTunes, Xbox Live and Dunkin Doughnuts have a range of cards available online.

5. Electricity

Cut your energy usage by unplugging your charger cables, television, microwave etc. when not in use.

You probably think that when you turn off lights and fans when not in use then you have done your part on saving the electricity but that is not totally true. One particular source of energy wastage is ‘phantom usage’, which is when plugs use small amounts of electricity from your sockets even when they are not in use. Another way to save is electricity is to buy LEDs, they are expensive but in the long run they are profitable.

6. Books

Rent a book from the library or download an e-book online rather than purchasing the hard copy.

Going to your favourite book store every now and then and picking up a bunch of new reading material certainly feels nice at once but it costs you a lot more in the long run. There are many alternatives that can save you a lot of that hard-earned money like renting the same exact book from the library or free e-book downloads.

7. Cell Phone Bills

Change your monthly plan according to the usage to avoid paying for the services that you didn’t even use.

Cell phones have now become a necessity and hence are available at affordable prices. But not everyone can afford those pesky cell phone bills. If you’re feeling that you are paying more than you utilize the services for then you should consider changing your monthly/yearly plan or switching to some other service provider.

8. Car Insurance

Take quotations from different car insurance companies and select the one which best suits you.

You probably ignore those car insurance advertisements on television and radio, but they have a good point. You can actually save on your car insurance instalment by shopping around. Even if you find a good deal but you want to stick with your service provider then you can always take those figures to your insurer and negotiate your way down.

9. Antivirus Software

Download free antivirus software from the internet rather than buying it.

Antivirus is not something that you should compromise with when it comes to cyber safety but that doesn’t mean you need to spend a lot on it. There are so many other options like free antivirus software available online that provide you subscription for an year. Even Windows has a pre-installed antivirus called ‘Windows Defender’.

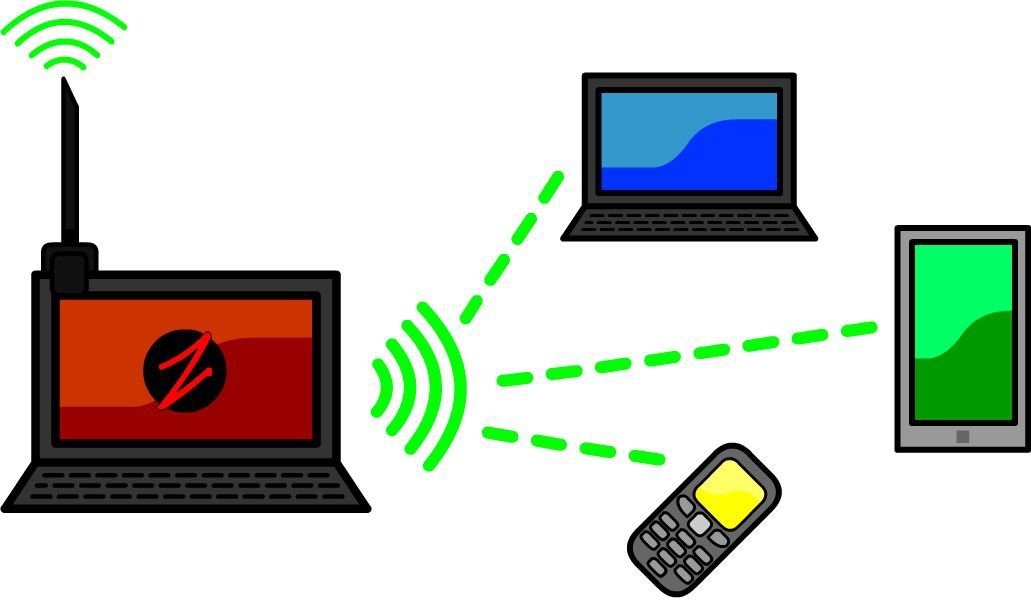

10. Internet Plan

Internet is how we get through our days now. It’s more like a need than just a source of entertainment. But you are probably paying more than what you are consuming. So looking through all the plans and keeping your consumption in mind, you should choose a plan that best fits your monthly or yearly use. You can also share your internet plan with your neighbour.

11. Restaurants

Download applications that provide you with cash-backs and be aware of circular ad wave coupons.

If you are a foodie then you know how much it takes to calm down that craving you have for a particular type of food. But with all those taxes and extra charges it costs a lot more than it actually should. So what you can do is download some applications that help you reserve tables at restaurants and provide cash backs as well. You should also keep a look out for the ad wave which distributes coupons and gift cards that you can use at a restaurant.

12. Grocery

Use coupons from the newspapers and keep a check on the weekly sales.

The monthly groceries take a toll on your wallet every time you visit that super mart, but there are a lot of ways to save money at a grocery store. Clip coupons from the daily newspaper and magazines; be aware of circular ad wave, and stock up on items when they’re on sale. Nowadays, you can buy them online too at a much cheaper price, which will save your fuel also.

13. Gym Membership

Bargain your way into getting a cheap yearly deal or just watch and learn from basic home exercise videos on Youtube.

Most people don’t realize that they can negotiate the price of a gym membership. Often, with a little bit of wrangling, you can get the enrolment fee waived or cut down on monthly payments. Other than that, there are videos available online which shows you how to exercise without the use of heavy machinery.

14. Clothes & Shoes

Try them out at the store and buy them online where you can get a discount.

Branded clothes and shoes are treated as a luxury, but they come with a price tag that only some can afford. So what you can do is go to the store, try your outfit in your particular size and then buy the same exact thing online at a much cheaper price.