Credit is the ability of a customer to obtain products before payment, based on the trust that payment will be made in the future. A credit card is only an automatic way of offering credit to a consumer.

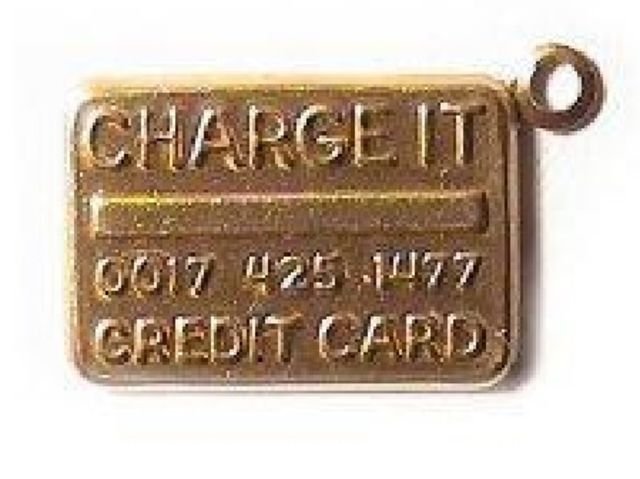

The concept was first introduced in 1946 by John Biggins, Brooklyn banker and the card was named ‘Charge-It’.

When a customer made a purchase using this card, the bill was forwarded to Biggins’ bank. The bank paid the merchant and later on obtained the payment from the customer. But the purchases could only be made locally, and it was compulsory for Charge-It cardholders to have an account at Biggins’ bank.

A credit card that could be used at more than one place was not invented until 1950. It all started when Frank X. McNamara went out to supper with his two friends and when it was time to pay, McNamara realized he had forgotten his wallet. Theory says that he had to call his wife and ask her to deliver some cash.

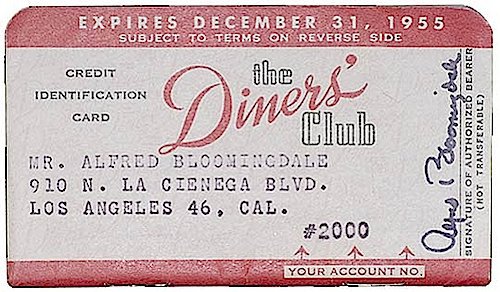

After this incident, McNamara came up with an idea – a credit card that could be used at multiple locations. McNamara discussed this idea with Bloomingdale and Sneider and started a new company in 1950, ‘The Diners Club’.

The Diners Club was more like a middleman, instead of individual companies offering credit to their own customers, the Diners Club was going to offer credit to individuals for multiple companies. The Diner’s Club made a profit by charging stores a 7% fee on all purchases and demanding customers to pay a $3 annual fee. The first Diners Club credit cards were given out to 200 people, mostly McNamara’s friends and acquaintances in 1950 and accepted by 14 restaurants in New York. By 1951, there were 20,000 Diners Club cardholders.

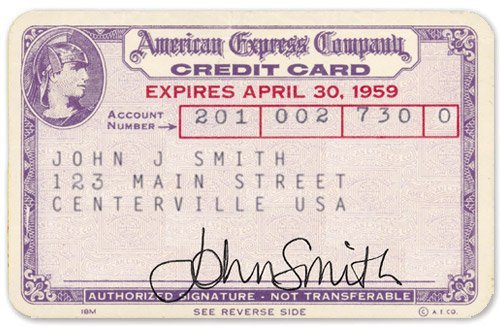

In 1958 the company launched its own product, a purple charge card for travel and entertainment expenses. In 1959, the first card made of plastic was introduced by American Express (previous cards were made of cardboard or celluloid).

Credit card use didn’t really take off until 1978, though, when a Supreme Court ruling permitted nationally chartered banks to charge the interest rate set in the bank’s home state to out-of-state customers.