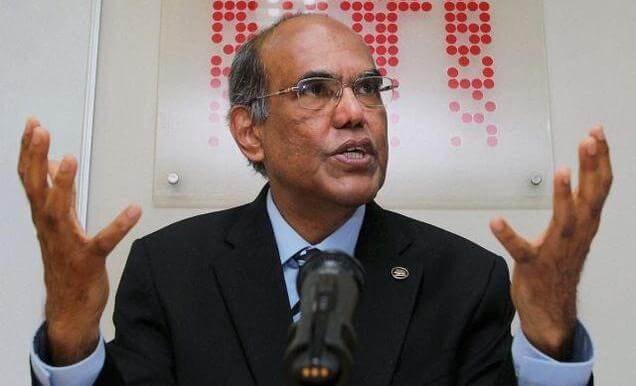

In scathing comments on his bosses in North Block, former RBI governor Duvvuri Subbarao has alleged that ex-finance ministers P Chidambaram and Pranab Mukherjee interfered in the functioning of the central bank, especially on setting interest rates, and the differences even led to two of his deputies not getting extensions.

“Both Chidambaram and Pranab Mukherjee were piqued by the Reserve Bank’s tight interest rate policy on the ground that high interest rates were inhibiting investment and hurting growth,” writes Subbarao, who manned the Mint Road during the global financial crisis and had a five-year tenure from September 5, 2008 to September 4, 2013.

The comments in the ‘Who Moved My Interest Rates’- Leading the Reserve Bank of India through Five Turbulent Years, a tell-tale memoir running into 352 pages and hitting the stands on Friday, come within a month of present RBI Governor Raghuram Rajan refusing to accept a second term, apparently upset by the personal criticism levelled against him.

The book narrates how Chidambaram and Mukherjee, as finance ministers during his term at the central bank, often made public their differences with the RBI on decisions on policy rates.

According to Subbarao, who led the RBI through five turbulent years since the fall of the Lehman Brothers, there was not only pressure on him from Chidambaram and Mukherjee to cut interest rates, but his refusal to do so cost him dearly.

“I have been asked several times if there was pressure from the government on setting interest rates. There certainly was, although the precise psychological mechanics of pressure would vary depending on the context, setting and personalities,” he has written in the book.

He goes onto say that he had to pay the price for not falling in line as the government turned down Subbarao’s recommendations to give extension to two of his deputy governors–Usha Thorat during Mukherjee’s tenure and Subir Gokarn when Chidambaram returned to the finance ministry.

Subbarao recalls that throughout his five-year term, the government was very uncomfortable with the RBI for raising interest rates and blamed this for falling growth rates. “The logic of why the Reserve Bank should compromise its judgement so as to become a cheerleader for the economy never appealed to me,” he writes.