If there is one mistake I made while growing up, and in college, it’s having no control over myself while shopping. My biggest weakness was going to the Sarojini Nagar market. Which just by the way, is not a bad place to shop from, it’s just a little questionable in terms of the quality of clothing you get. And as I grew up, I began to understand the value of quality versus quantity.

I soon came across a documentary called The Minimalists: Less Is Now. And that, you could say led to my financial awakening. I began asking questions like, “Why do I even need 3 blue t-shirts, or multiple mugs in the same colour, or as many nail paints?” I wondered, “Why do I need dresses that I may never even get the chance to wear?”

The truth is that I was buying clothes that didn’t even last 6 months. I was spending ₹1000 on 10 clothing items every six months that would tear or be out of fashion in the next couple of months. What was the point?

It wasn’t only about clothes and home decor or dining-related expenditures. My mindset with respect to buying groceries, food, etc, was just as poor. Buying things carelessly can wreak havoc on the environment, and on your personal finances.

This was not an overnight transition. It took me years to start spending wisely (and am still learning TBH). I even had to accept that if I was going to choose this lifestyle, I was going to be at the receiving end of a lot of jokes about being kanjoos or being an “Over-thinker.”

But the truth is spending mindfully is the best thing I started doing. So, here are a couple of things you can start doing to manage your finances with the principle of minimalism, too:

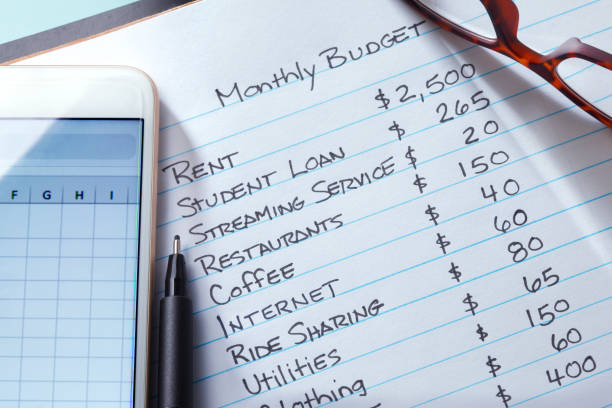

1. Create a monthly budget

Even if you’re not keeping a record physically or digitally. Make a habit of mentally sorting through your expenses.

2. When shopping for clothes, check the material they’re made of

Also, check how they’re made. Learn about the kinds of fabrics that last the longest. Clothes are an investment of a sort, after all.

3. On that note, create a capsule wardrobe

Buy basic items of clothing, that you can wear on multiple occasions so that you don’t end up impulse shopping.

4. Cooking is mostly cheaper than ordering or eating out

So, learn to cook, and order groceries carefully, so as to not let any go to waste.

5. Learn to take care of your material possessions so that they last longer

Learn how to preserve and store your winter clothes, learn how to take care of your bags, how to clean them gently, so that the cleaning process doesn’t wear them out quicker. Find better ways to wash clothes, with gentler, chemical-free detergents. Because, if you’re buying less, good quality stuff, taking care of them properly can make them last thrice as long.

6. When shopping for luxuries, always use the process of elimination

This doesn’t necessarily mean designer, it’s anything you consider a comfort, a want, rather than a need. For instance, say you want to buy 5 things, think twice about which of those you can live without, or buy in the coming month.

7. It’s important to ask yourself if you’re hoarding

The point of minimalism is to live with and consume less. There is nothing wrong with wanting more for yourself, but there is a difference between hoarding and curating. Because buying 3 journals doesn’t guarantee you’re going to use all three of them, chances are, you’re going to end up with an empty one, lying in the corner of your cupboard, and forgetting about it until it’s too late.

8. Think of almost everything as an investment

Is the food you’re eating fuelling your body or creating illnesses? Are the accessories you’re buying going to add to the quality of your life, make things easier for you, or merely be a source of entertainment?

9. Be selective

A forewarning, people will call you ‘bougie,’ ‘picky,’ or ‘choosy,’ for being selective about the things you want to eat, wear or use. But, if you ask me, it’s worth it; If it means you’ll have a chance at living comfortably as you grow older, in this wretched economy, then it’s definitely worth it.

10. Get comfortable with shopping at discounts

It’s okay to buy second-hand, it’s okay to be on the lookout for deals and discounts if that means you’re saving money. Us Indians resist buying second-hand clothing, but if you’re getting a good quality item, for one-third of the original price, what is really wrong with that?

Taking a minimalist approach towards managing your finances is hard, it requires a lot of self-control, but it also results in more financial security later on in life. And I think this is something many people (especially women) are looking to achieve right now.